1 How are you going to pay for these expenses? Some of your income will probably originate from fixed sources, such as Social Security benefits, pensions and annuities.

Bureau of Labor Statistics, a household run by someone 65 or older spends on average $52,141 per year (approximately $4,345 a month). Your expenses may fall into three categories: essential (must-have), discretionary (optional) and one-time (a remarkable but necessary occurrence).Īccording to the U.S.

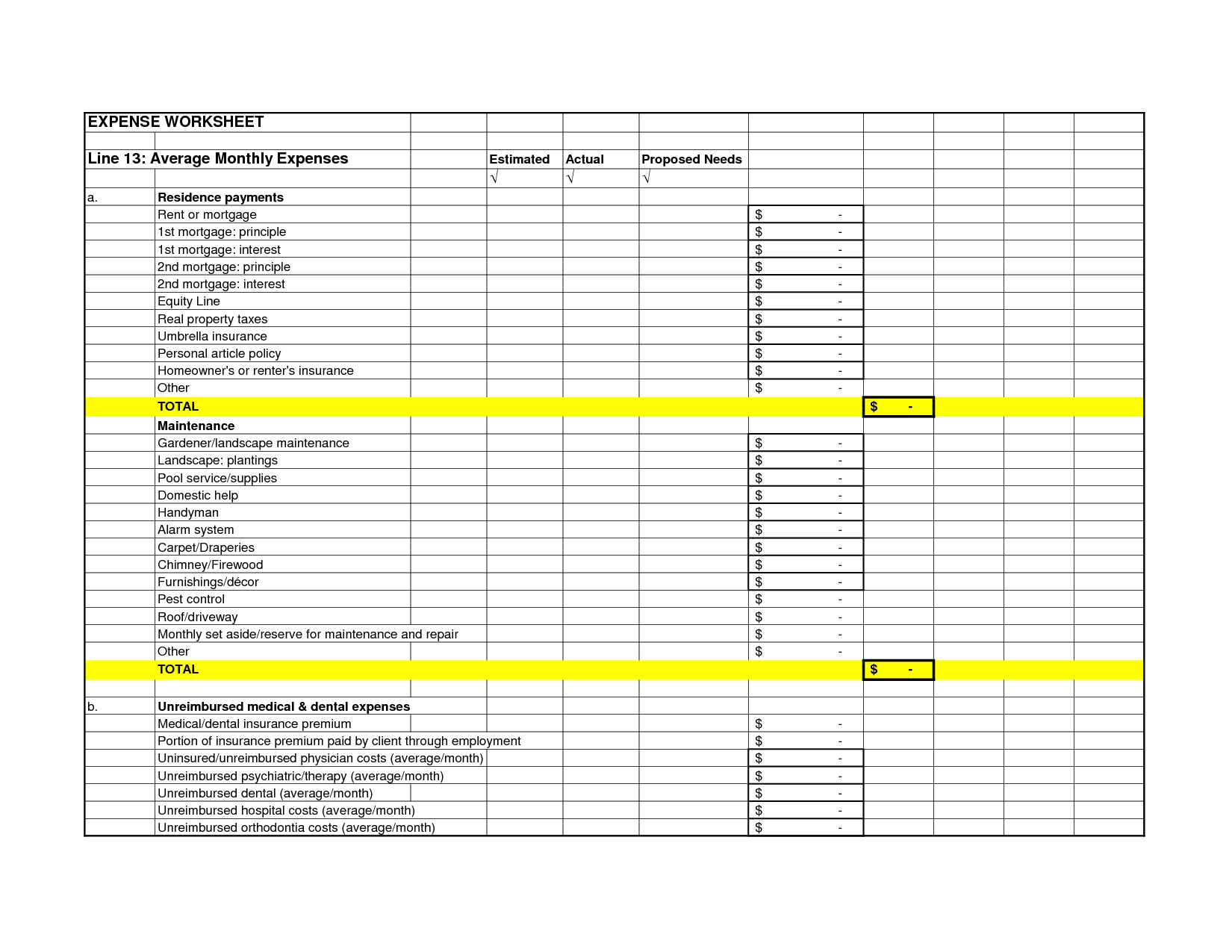

This will help you determine the retirement income you’ll need to meet your average monthly expenses as well as cover surprise expenses. When you turn age 73, you’ll have to begin withdrawing required minimum distributions from most retirement accounts.Įssential, discretionary and one-time retirement expensesįirst, understand what types of expenses you’re likely to incur and how big they’re going to be each year. For example, you may have ongoing expenses for a specific amount, but you may also have a fixed expense that lasts only a certain number of years, such as a mortgage.Īs you complete your budget planning worksheet, you must also take into consideration your changing income picture. It’s important to itemize and categorize your anticipated average monthly expenses as you plan your retirement spending.

To help avoid being caught short unexpectedly, start now by making a list of your anticipated costs.

As you estimate what your spending in retirement might be, it can be easy to underestimate your expenses. To calculate your retirement budget, it’s best to first calculate your expected average costs per month. Building this budget is a step-by-step process. You may be faced with new and greater expenses, however, and having a budget becomes even more crucial to help you live effectively off of your savings. Building a budget for your spending in retirementīudgeting your spending in retirement looks and works similarly to the way it does in your working years.

0 kommentar(er)

0 kommentar(er)